I'm not stepping out on a ledge by saying that most 15-year-olds don't have a clue about money.

“It turns out that most young people aren’t ready to be in charge of their own money. Only 12 percent scored at the highest level of financial literacy, and 22 percent “score below the baseline level of proficiency,” according to the Organization for Economic Cooperation & Development, which runs the Program for International Student Assessment, better known as PISA. The study results were released May 24.”

What's interesting is 38% of the performance on the test can't be explained by the student's ability in math and reading. In other words, your kids can excel at algebra, but still screw up personal financial decisions.

Adults may think that they would fare much better, but they would be WRONG. Here's the proof.

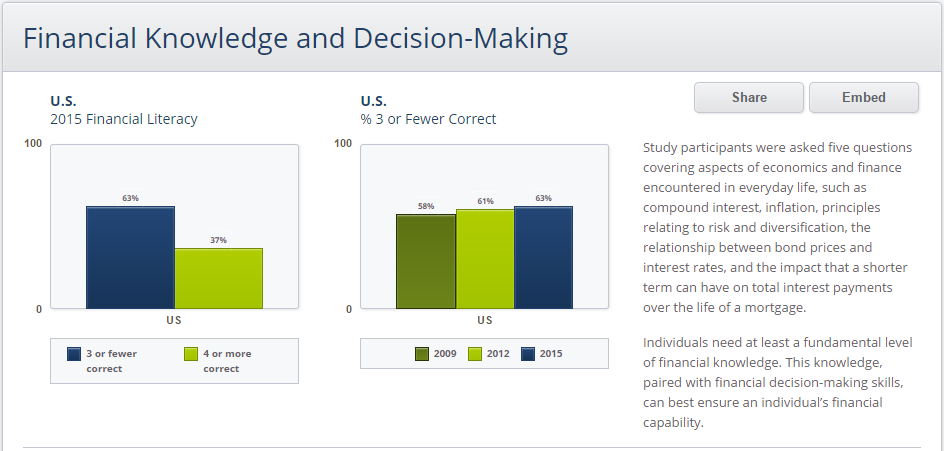

This report from the FINRA Investor Education Foundation states that two out of three U.S. adults "lack financial literacy" and that only 37% of Americans could pass a basic economic/financial knowledge test.

These are basic and straightforward concepts in personal finance. So imagine when you're presented with financial products with 100's of pages of fine print, by an industry that is dominated by agents and brokers not working in your best interests. To quote President Trump, "Sad!" (BTW, here's why we're different)

If you're interested to see how you'd do, here's the 15-year-old test and the adult version.